For CISOs leading security in financial services, 2025 presents a turning point. Cyberattacks are no longer singular, blunt-force events. They are sophisticated campaigns designed to evade traditional detection, exploit regulatory blind spots, and erode institutional trust. And while artificial intelligence has created efficiencies for defenders, it has also supercharged the capabilities of attackers.

The sector now stands at the intersection of massive digital transformation and unprecedented threat complexity. With rising economic instability, geopolitical tension, and expanding third-party ecosystems, banks, insurers, and capital market firms are squarely in the crosshairs of both criminal syndicates and state-sponsored actors.

In its April 2025 Global Financial Stability Report, the IMF highlighted that nearly one in five cyber incidents now target financial institutions, placing the sector at heightened risk. While most direct losses remain manageable, the potential for extreme events costing as much as $2.5 billion has grown significantly1. These incidents could erode trust, disrupt essential services, and trigger ripple effects across the broader financial system, making cybersecurity a systemic stability issue. In this environment, CISOs must evolve from reactive defenders to proactive strategists arming their organizations not just with tools, but with intelligence. The mission: detect threats early, understand attacker intent, and disrupt before damage occurs.

So, what’s coming next, and how should you prepare?

The Top 5 Threats To Financial Services Cybersecurity in 2025

Financial institutions now face cyberattacks that strike faster, hide deeper, and adapt in real time. This demands a new level of defensive agility. Below are the five most pressing threats CISOs need to anticipate and counter with urgency in 2025.

AI-Driven Impersonation and Deepfake Fraud

In 2025, phishing has evolved far beyond emails and fake login pages. We are now firmly in the era of synthetic social engineering, where generative AI enables attackers to create convincing deepfake videos, clone executive voices, and replicate employee behavior patterns with chilling accuracy.-

These AI-powered attacks are not just clever, they are contextually intelligent. Attackers can scrape publicly available video, audio, and speech patterns from earnings calls, YouTube interviews, or even LinkedIn videos. They then use this data to fabricate hyper-personalized content that appears authentic to the untrained eye (and sometimes even to trained analysts).

This presents a significant challenge for financial services organizations that still rely on voice verification, internal protocols, or even face-to-face video calls as standard validation practices. Traditional verification is no longer enough. With deepfake incidents on the rise and synthetic identity fraud expected to cost institutions over $5 billion globally this year, the question for CISOs is not “if” these attacks will happen, but whether their teams will see them coming when they do.

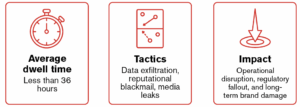

Ransomware Becomes Fast-Paced Extortion

Ransomware Becomes Fast-Paced ExtortionRansomware attacks in 2025 have become leaner and more lethal. Rather than encrypting systems, today’s attackers focus on rapid data theft, extortion, and stealing sensitive financial data and threatening to leak it unless paid quickly.

These attacks are highly targeted, often hitting payment systems, customer records, or regulatory archives. For financial institutions that operate on trust and uptime, the stakes couldn’t be higher.

In one real-world example, a CounterCraft client saw an attacker attempting to move laterally into its SWIFT infrastructure. Instead of blocking the threat outright, the team redirected the intruder into a deception environment.

The result? Full visibility into the attack path and tools without any risk to live systems. By turning attacks into intelligence, deception technology gives CISOs the advantage, allowing teams to detect, delay, and defeat threats before they escalate.

- Misconfigured cloud services that expose sensitive data to the internet

- Unsecured APIs used for payment processing or customer onboarding

- Inadequate monitoring of vendors and software updates across the digital supply chain

- DORA: Requires threat-led penetration testing, incident response, and operational resilience across the entire digital ecosystem. We have an whitepaper on DORA compliance, available here.

- NIS2 Directive: Expands mandatory reporting and imposes stricter controls on critical infrastructure and supply chains. Check out this blog on how to boost NIS2 compliance.

- PSD3 & Open Banking Reforms: Introduce new standards for payment security, fraud detection, and consumer protection

- AI Act & UK CTP Framework: Bring AI systems and critical third-party providers under direct regulatory scrutiny

- Threat Visibility: Move beyond log analysis. Deploy deception to see attacker behavior before damage occurs.

- Third-Party Oversight: Implement real-time monitoring of vendor access and activity, not just annual audits.

- Integrated Cyber-Fraud Fusion: Break down silos between cyber, fraud, and identity teams to detect modern threats.

- Regulatory Harmonization: Create a unified compliance framework to address DORA, PSD3, AI Act, and more.

- Customer-Facing Security Positioning: Elevate security messaging to become part of your brand’s value proposition.

- Deploy deception campaigns at scale across hybrid, multi-cloud, and core banking environments

- Gain faster, deeper insights into attacker behavior, with enriched telemetry that fuels threat hunting and incident response

- Integrate seamlessly with your existing security stack (SIEM, EDR, TIPs, etc.) for a more proactive SOC

- Tailor decoy assets to mimic high-value targets like SWIFT infrastructure, payment gateways, customer portals, and IAM systems

Supply Chain Compromise and Third-Party Risk

Supply Chain Compromise and Third-Party RiskFinancial institutions rely on a vast ecosystem of third-party platforms, fintech tools, cloud providers, and data processors. While this enables innovation and efficiency, it also expands the attack surface far beyond the enterprise perimeter. This interconnectedness is now one of the largest blind spots in cybersecurity strategy.

Key vulnerabilities include:

Even with best-in-class internal defenses, a breach at a single overlooked supplier can become a front door into your core infrastructure. In 2025, threat actors are increasingly targeting third-party weak points, knowing that many financial firms still rely on static assessments or outdated vendor contracts. But tick-box compliance is no longer sufficient. What’s needed is continuous, real-time third-party risk intelligence, providing a proactive approach that monitors for behavioral anomalies, access abuse, and supply chain drift before it becomes a breach.

Compliance Overload and Fragmented Regulation

Compliance Overload and Fragmented RegulationIn 2025, staying compliant has become a strategic challenge in itself. The regulatory landscape for financial services is evolving rapidly, introducing overlapping mandates, shortened timelines, and broader scopes that touch everything from third-party oversight to AI governance.

CISOs are now expected to lead compliance efforts across a shifting global patchwork of frameworks, including:

Each of these frameworks carries real financial, legal, and reputational consequences, and yet they don’t always align in scope or implementation timelines. The answer lies in harmonizing regulatory strategy with security architecture, building flexible, threat-aware systems that satisfy multiple frameworks simultaneously. Deception technology supports this by providing evidence of real-time threat detection, incident response capability, and supply chain visibility, all of which can be mapped directly to compliance requirements.

Identity as the New Battleground

Identity as the New BattlegroundAs threat actors sharpen their tactics, identity is quickly becoming the most exploited attack vector in financial services. In 2025, the convergence of identity theft, account takeover, credential stuffing, and synthetic ID fraud is reshaping how CISOs must think about access, trust, and user validation.

These aren’t isolated issues, they’re systemic risks that span across cyber, fraud, and compliance domains. Today’s customers expect fast, frictionless access, but they also demand strong protection. If attackers can impersonate a trusted executive, customer, or service provider without detection, the result isn’t just a breach, it’s a crisis of confidence.

To counter this, fraud teams, SOC analysts, and IAM leaders must move beyond siloed tools and collaborate in real time. Shared intelligence, cross-functional detection models, and deception-based validation traps can help spot anomalies early, before access is abused or reputational damage is done. In this new battleground, the institutions that win won’t just verify identities, they’ll outmaneuver the imposters trying to replicate them.

Your 2025 Security Playbook: Five Priorities for CISOs

To lead security effectively in 2025, CISOs in financial services should prioritize:

A Shift in Strategy: From Perimeter Defense to Proactive Disruption

The threats of 2025 demand more than updated antivirus software or longer passwords. They demand real-time insight into attacker behavior, and the ability to act before damage is done.

That’s where deception-powered threat intelligence delivers a decisive advantage. Instead of simply reacting to threats, CounterCraft clients observe, learn, and act with precision, often before attackers realize they’ve been discovered.

Why Deception Technology Works

Digital Twins

Lifelike decoy systems that engage attackers in isolated environments

Live Adversary Telemetry

Captures attacker tools, paths, and behavior for analysis

Reduced False Positives

SOCs only receive alerts on real adversary interactions

Faster Incident Response

Early detection shortens breach containment time

See How CounterCraft Helps

The cyber threats facing financial institutions in 2025 aren’t just faster and smarter—they’re systemic. They aim to erode trust, compromise core systems, and create long-term damage. This year, simply containing a breach is no longer a win. Control and disruption are the new benchmarks.

To meet them head-on, security leaders need more than visibility, they need control, context, and foresight. By deploying deception technology, building intelligence into your stack, and aligning security with strategy, you’ll be positioned to outthink adversaries, not just outlast them. That’s where CounterCraft’s latest capabilities deliver a game-changing edge. With powerful new enhancements, financial services organizations are now able to:

Our latest platform release introduces major enhancements that empower financial services organizations to:

The outcome? You don’t just detect threats, you engage and observe attackers in real time, transforming your response posture from reactive to truly intelligence-led. Financial institutions using CounterCraft report reduced dwell times, fewer false positives, and faster decision-making in high-risk scenarios. Most importantly, they’re able to capture threat actor intent before any breach occurs.

Ready to See It in Action?

Request a Demo to explore real attack scenarios, see how deception environments work, and experience how CounterCraft turns intrusions into intelligence, giving you the clarity to act, the control to disrupt, and the confidence to defend forward.